Offers and discounts

No Cost Emi available*On Purchase of Service worth 10,000 Rs. Or More |

Get a Website worth Rs. 24999/- for your Company in just 9999/-*(Powered by Gyan Uday Technology) |

GST InvoiceGet Gst Invoice & Claim Gst Credit for your Business with every Invoice |

Recently the Central government launched a zero-cost Micro, Small, and Medium Enterprises (MSME) portal by the name Udyam Registration. This postal is a cost-free platform for all small and medium enterprises for easy registration of their startup. This portal is converged with the Income Tax and Goods and Services Tax Identification Number (GSTIN) that can consequently pull PAN and GST-connected details. Likewise, the MSME Udyam is a basic and reliable process, but if you don’t want to face any issue while registering, then it is required to take the help of an expert. So that, it becomes easy to submit all required and appropriate documents. Taking the help of an expert is never a deal of loss especially if it is related to your business or career. Here in this article, you will get all the important information that will help you in completing your registration on the Udyam portal.

After covid-19 lockdown, various MSME loan scheme has been announced by PM Narendra Modi to give financial assistance to MSME registered business and boost the economy, so registering your business in Udyog Aadhaar will help you a lot.

Retail, wholesale traders now get MSME tag: On June 28, the Finance Ministry increased the Emergency Credit Line Guarantee Scheme (ECLGS) to Rs 4.5 lakh crore, which is mainly for the MSME sector.

Notification No. 5/2(2)/2021-E/P & G/Policy

MSME has issued order to include retail and wholesale trade as MSME and extending to them the benefit of priority sector lending under RBI guidelines. The revised guidelines will benefit 2.5 Cr Retail and Wholesale Traders.

Government announces inclusion of Retail and Wholesale trades as MSMEs

Definition as per Micro, Small and Medium Enterprises Development (MSMED) Act, 2006

As indicated by the MSMED Act 2006, Micro, Small, and Medium Enterprises are divided into two categories:

Enterprises for service: - They require investment in equipment. The main focus of these enterprises is offering the best possible service to customers.

If you are new to business or looking for a switch in your work then it is important to know the best way to get it done easily. First of all, you should enroll yourself on the Udyam portal. The following are steps that can be followed to register on the MSME Udyam portal:

To get the MSME registration, the most important thing is that you need to apply for the Provisional SSI registration certificate. This certification is for a pre-activity period, for example when you have not started your activities although there is a marketable strategy. It also helps the unit of MSME to get a loan and working capital.

Note: It is valid for five years.

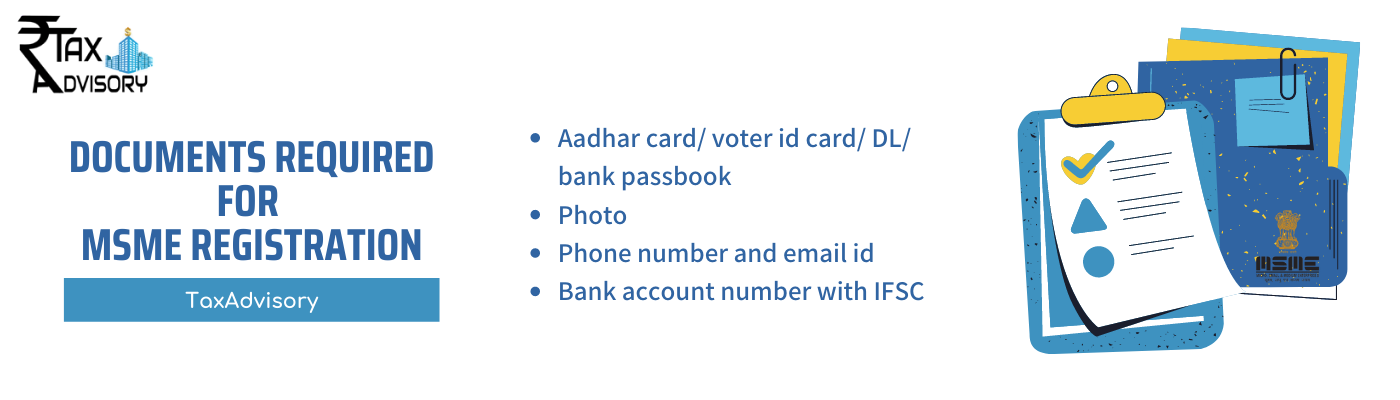

In case of partnership: It requires a copy of the deed. It is not required to be enrolled under the Partnership Act.

In the case of a Private Company: A certified copy of MOA and AOA is required along with an incorporation certificate. Many additional documents are there to complete the process of registration.

You might be required to submit more or a few other documents as per the details filed but to avoid facing problems you can take the help of Tax Advisory. We are always there for you to provide instant solutions and make the process of MSME registration hassle-free. So that entrepreneur can focus on other important things which are required for the growth of the business.

At present, an MSME certificate can help the owner to start the production in the factory. After the start of production, they can apply for a permanent permit or license.

Permanent SSI Registration

If you start your business or construction, instantly apply for Permanent SSI registration. This is also possible by applying on the portal through the state site. For the online process, you can apply through the department's zonal office or district office.

The unit should not violate any local restrictions.

These units must get approval from the Drug Control Board, Pollution Control Board, etc.

If the unit is listed in Schedule-III of the Industrial Licensing Exemption Notification.

The unit should not be possessed or constrained by any other industrial effort.

The entrepreneur can apply for a Permanent Registration Certificate without an industrial permit. Different units must have a such permit.

The value of the plants including equipment must be within the approved range for which you are applying.

Bank Loan (Collateral Free) - When you get MSME registration, it will provide you MSME loan without guarantee. It will be a great financial aid for your business in slow economic growth.

Low-interest rates- When you have an MSME certificate, the bank will give you a loan on a low-interest basis. After the Covid-19, the interest rates have been halved after the package was released by PM Modi. One advantage of this is that bank loan tends to be less expensive as loan fees are exceptionally low like around 1 to 1.5%.

Subsidy on Patent Registration- If you apply for patent registration, you have to pay a fee of Rs. 4000 or 8000 as per the type of your application. Along with the MSME certificate, you will receive half of the subsidy amount on submission of your application to the ministry.

Business Promotion Subsidy- MSME registration will provide you the benefits of various business promotion subsidies announced by the state and central government.

Reduced Electricity Bill- Some states also give you a reduction in your electricity bill if you have an MSME certificate by contacting the electricity department with proper documents.

ISO Certification Fee Reimbursement- MSME registration will provide you a reduction in the ISO fee paid on the ISO certification of your product. Businesses listed under MSME are given a high inclination for government permits and certificates.

Opening Current Account- If you do not have GST registration, then you will face problems in opening the current account of your business. MSME certificate is accepted by many banks for opening a current account in absence of any proof of business constitution.

Exemption under Income Tax- If you have an MSME certificate then you can avail income tax benefits for your business in the initial year. Under MSME, various fee exemptions are offered to the proprietors.

Permission to enter International Exhibition- If you are involved in the import-export business, then you can participate in various international forums, exhibitions and hire with an MSME certificate.

Protection for non-payment- If you do not receive payment for your business, then you can sue the party for non-payment with the help of MSME registration.

There is a one-time settlement fee for non-payment measures of MSMEs.

Credit is also allowed for Minimum Alternate Taxes (MAT). It is carried forward to 15-years instead of 10-years

For MSME businesses, several administrative tenders are open exclusively for them.

There are several exemptions and concessions available to them that reduce the cost of obtaining a patent or setting up a business whenever they are listed.

Tax Advisory will give you an MSME certificate in just Rs. 799/- (inclusive of all taxes). Pay here and get MSME registration in just 2 days. The above package includes-

If you are matching all these requirements, then it's time to get registered with MSME. In case of any query, feel free to get in touch with Tax Advisory, we can help you in getting your registration certificate and also guide you for further required steps. So, what are you waiting for? Get registered now!!!

Ans- Rs.799/-

Ans- The categories of MSME are micro, small, and medium enterprises. You can check the criteria defined above.

Ans- Yes, if you are a manufacturer and service provider, then you can get your business registered in MSME.

Ans- MSME loan can be applied online. For MSME Atmanirbhar Package Loan, you have to approach your bank with an MSME certificate.

Ans- MSME registration is not compulsory but optional. However, its benefits make it essential to your business.

Ans- Yes. If you are a manufacturer or a service provider then you can get an MSME certificate.

Ans- No, it requires lots of detailed information. For this, you should take professional help. Any wrong information may result in the rejection of MSME registration.

Ans- Yes. You can track the processing.

Ans- 1 crore for small enterprises, 10-crores for micro-enterprises, 20 crores for medium enterprises.

Ans- Anyone can take an MSME certificate without GST registration by providing basic details like PAN, Aadhaar.