Offers and discounts

No Cost Emi available*On Purchase of Service worth 10,000 Rs. Or More |

Get a Website worth Rs. 24999/- for your Company in just 9999/-*(Powered by Gyan Uday Technology) |

GST InvoiceGet Gst Invoice & Claim Gst Credit for your Business with every Invoice |

Income tax e filing (A.Y. 2022-23)

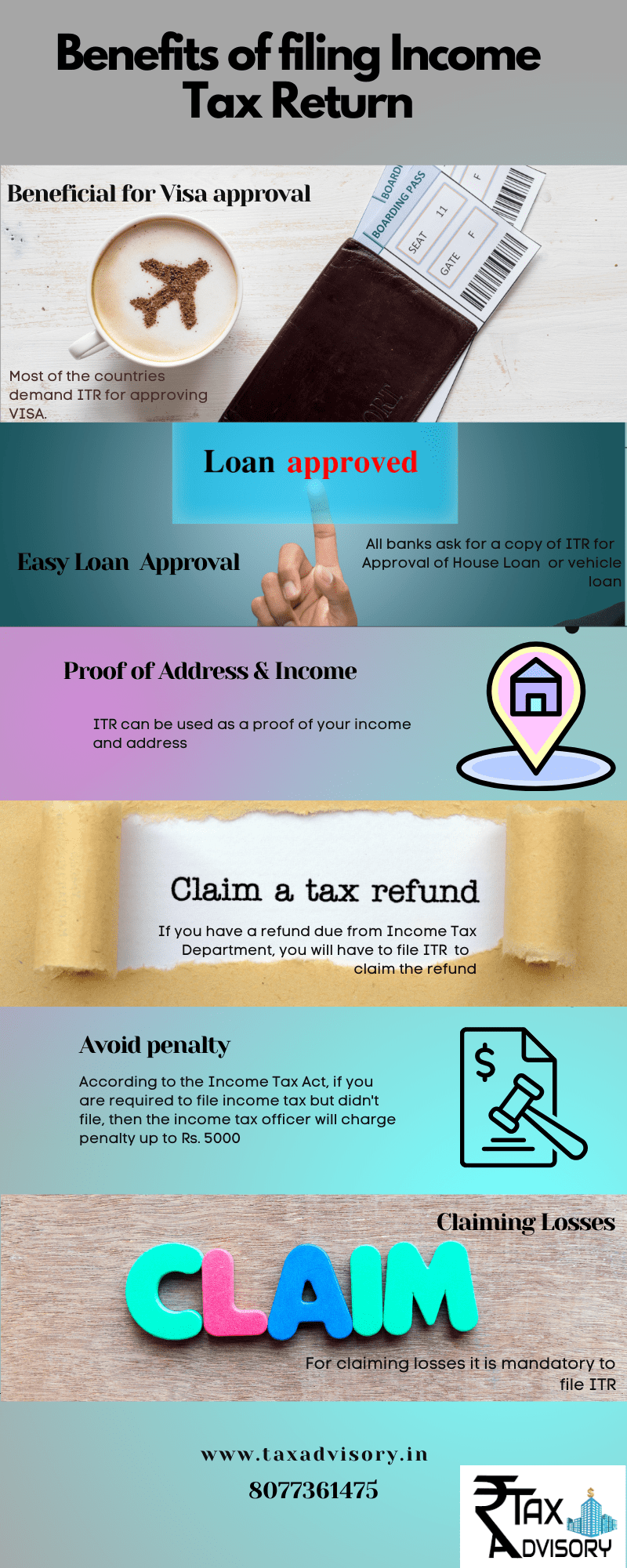

Income tax return or Income tax e filling is a form that is to be filed with income tax department in which the tax payer submits information about their income and tax payments to income tax department. The tax liability of a tax payer is based on his or her income. The income could be in a form of salary, business profits, income from house property or earned through dividends, interest and capital gain and from other sources. If in a case return shows excess tax amount paid by tax payer during a year, then the individual will be eligible to receive income tax refund from the income tax department.First, the tax payers need to determine the type of income tax itr form before actually filling their returns. Now you should check the form 26AS for details of TDS while Income tax e filing (A.Y. 2021-22). The ITR form applicable to a tax payer depends on the type of taxpayer whether individual, HUF, company etc.

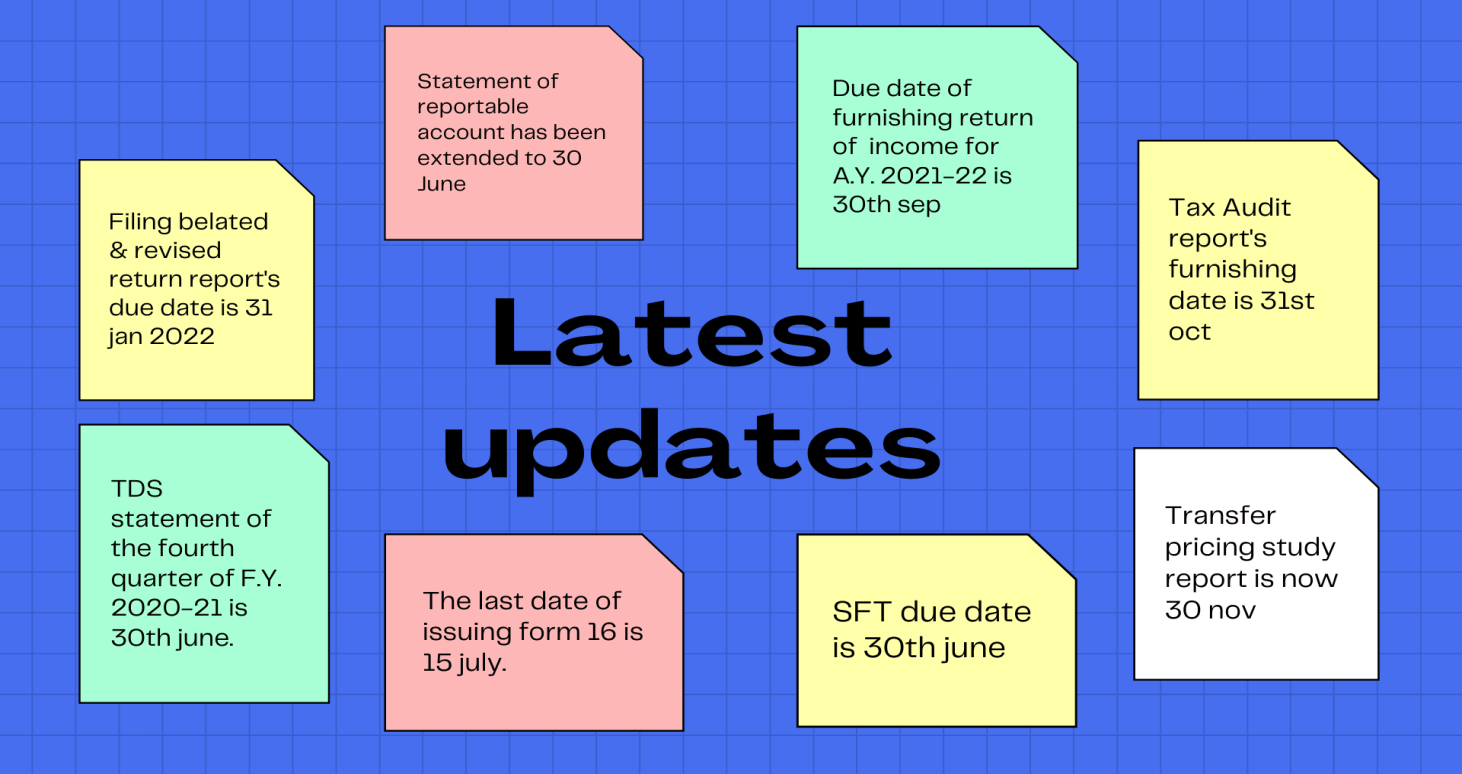

(Latest update) The central board of direct taxes (CBDT) has extended the deadline to file income tax return (ITR), allowing individuals to file their tax returns for income earned during the financial year 2020-21 by September 30, that means income tax return last date is 30 September.

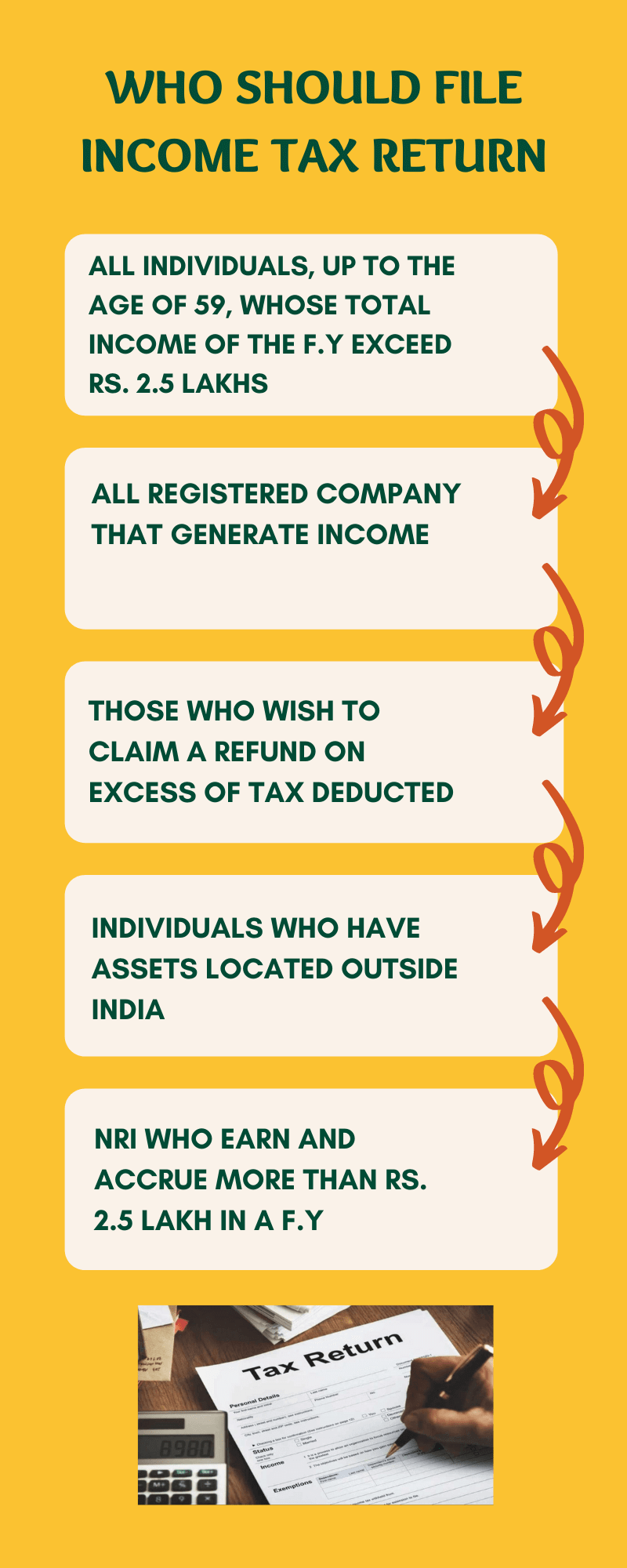

Any person who is less than the age of 60 and having income more than Rs. 2.5 lakh is required to file income tax returns, according to income tax act. For senior citizens, the cut off is Rs. 3 lakh and for those who are more than 80 years old, the cut off is Rs. 5 lakh.

|

Age of an individual

|

Basic exemption limit (Rs.)

|

|

Below 60 years of age

|

2,50,000

|

|

Between 60 and 80 years of age(senior citizen)

|

3,00,000

|

|

80 years and above(super citizen)

|

500,000

|

An individual must prepare all the required documents before filling the income tax return. Required documents are as follows:-

Form 16:- Form 16 is also known as the TDS Certificate (Tax Deducted at Source). Form 16 is the basis for filing the income tax returns. Thus form 16 is the first form that should be collected. This TDS certificate is issued to you by your employer; it contains details of salary paid to you and TDS deducted on it.

Form 16A:- It mentions TDS on interest income on fixed deposits. Form 16 is required to fill when TDS is deducted on payments other than salaries such as interest received from fixed deposits, insurance commission, recurring deposits etc. form 16A provides details of the income earned and TDS deducted and deposited on such income.

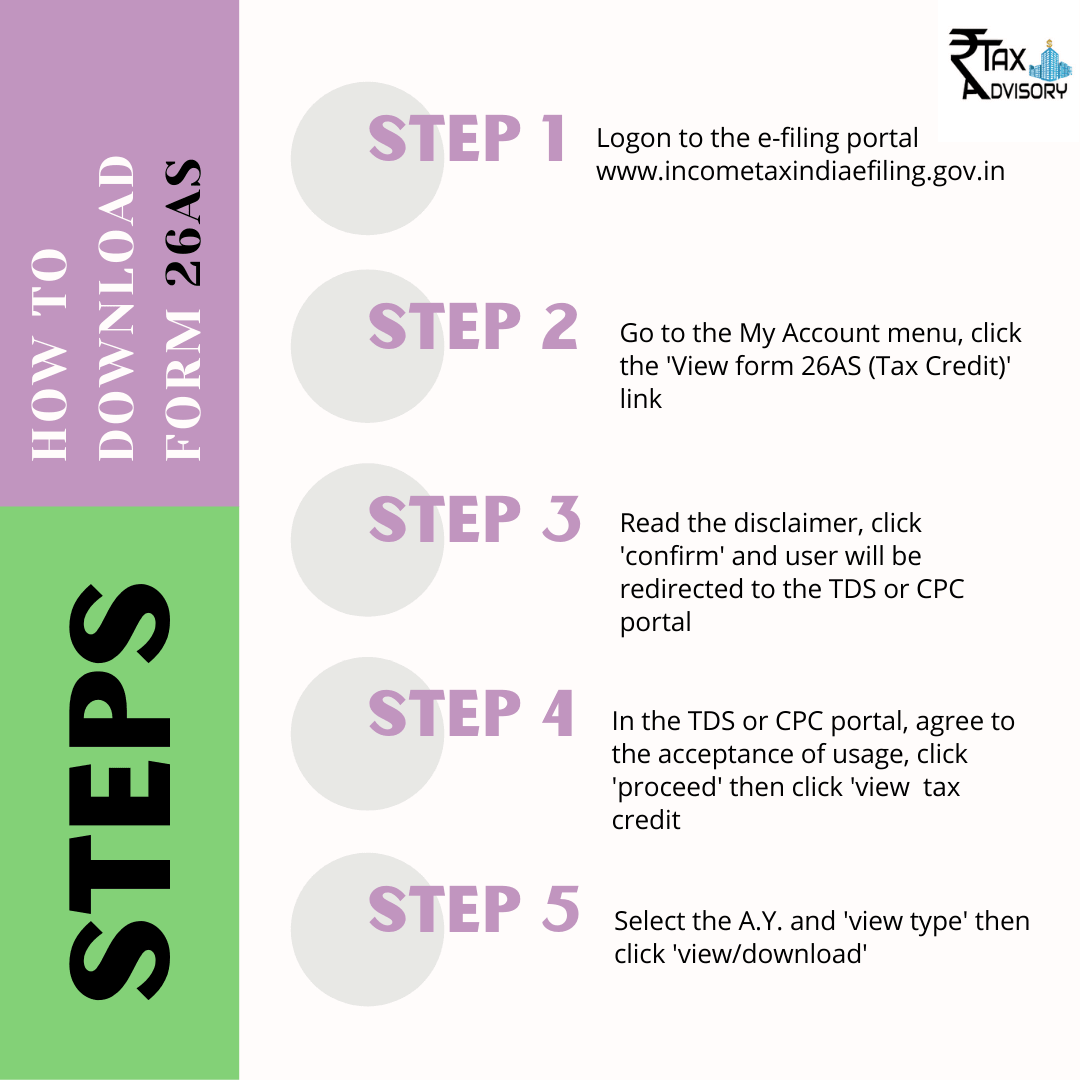

Form 26AS:- Form 26AS is also known as annual consolidated statement, this contains all tax related information of the tax payer. Form 26AS contains details which is tax deducted at source and details of advance tax. Form 26AS can be downloaded from official website of income tax department. This form shows details of sale/purchase of immovable property, mutual funds, cash deposits or withdrawal from saving account. An assessee can claim the tax deducted reflecting in their form 26AS while filing their income tax return for a financial year.

PAN Card: Your Permanent Account Number (PAN) acts as your identity proof and has to be mentioned in your income tax returns.

Aadhaar card: According to section 139AA of the income tax Act, an individual is required to provide his/her Aadhaar details while filing the return of your income.

Capital gain tax: In case if you have invested in shares, mutual funds, etc., you are required to collect a capital gain statement. This statement is issued by your brokerage house. It contains the details of the short term capital gains that are required to be paid in case you have exited certain shares before the tenure of one year. Even though you may not have to pay taxes on long term capital gains , you are required to mention them in software.

Salary slips: It is important to keep salary slip ready if you are a salaried tax payer. This salary slip includes details of basic salary, Dearness Allowance (DA), TDS amount, house rent allowance (HRA) and travelling allowance etc. These details are necessary to file income tax returns.

Deductions under section 80D to 80U: Apart from the standard deductions under section 80C, an individual can also claim exemption under section 80D to 80U of the income tax act.

Tax savings proofs: By claiming exemptions on the investments under section 80C, section 80CCC, and section 80CCD(1) of the income tax act. Few common tax savings are:

National pension scheme

Employee provident fund

Public provident fund etc

ITR 1- who is not eligible

ITR 2 download- who is not eligible

ITR3 filing- who is not eligible

ITR 4:- This form is to be filled by individuals, Hindu undivided family and firms (other than LLP) and resident having income up to 50 lakhs, income and gain from business or profession computed under Section 44AD , 44ADA OR 44AE.

ITR 4s- who is not eligible

ITR 5:- This ITR 5 is applicable to AOP/BOI/Executor of AJP

ITR 5- not applicable to

ITR 6:- This form is applicable to companies other than those claiming exemption under section 11

ITR 6- not applicable to

Step 1: first of all you need to visit www.incometax.gov.in and log in to the e filing portal using your ID and password.

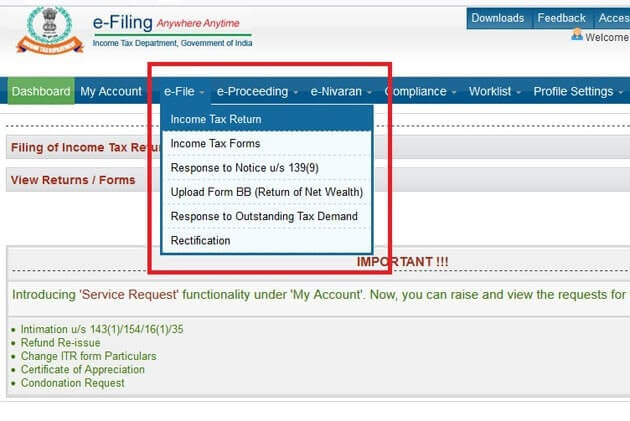

Step 2: On your Dashboard click on e-file then click on Income Tax Returns and then click on File Income Tax Return.

Step 3: Now select Assessment Year as 2021-22 and click Continue.

Step 4: Now select Mode of Filing as Online and then click Proceed.

Step 5: Select Status (Individual, HUF or others) as applicable to you and click on Continue button.

Step 6: Now you have to select the type of ITR, after selecting type of ITR gather the list of document needed and click on ‘Let’s Get Started

Step 7: Now review the data that is filled earlier and edit data if it is required. And click Confirm at end of each section.

Step 8: Enter your all income and deduction details in the different sections after completing all the details click on ‘Proceed’ button.

Step 9: If in this case there is any Tax liability you will get two options ‘Pay Now’ or ‘Pay later’ (It is recommended to use ‘Pay now’ option).

Step 10: After paying tax liability click on Preview Return button, now you will be taken to Preview and Submit your Return page. In this page you have enter place, select checkbox and click ‘Proceed to Validation’.

Step 11: After successful Validation on Preview and Submit your Return’ Page click on ‘Proceed to Verification’

Step 12: Now you have to e-verify your return, after e-verify you will get a success message along with Transaction ID and Acknowledgment Number.

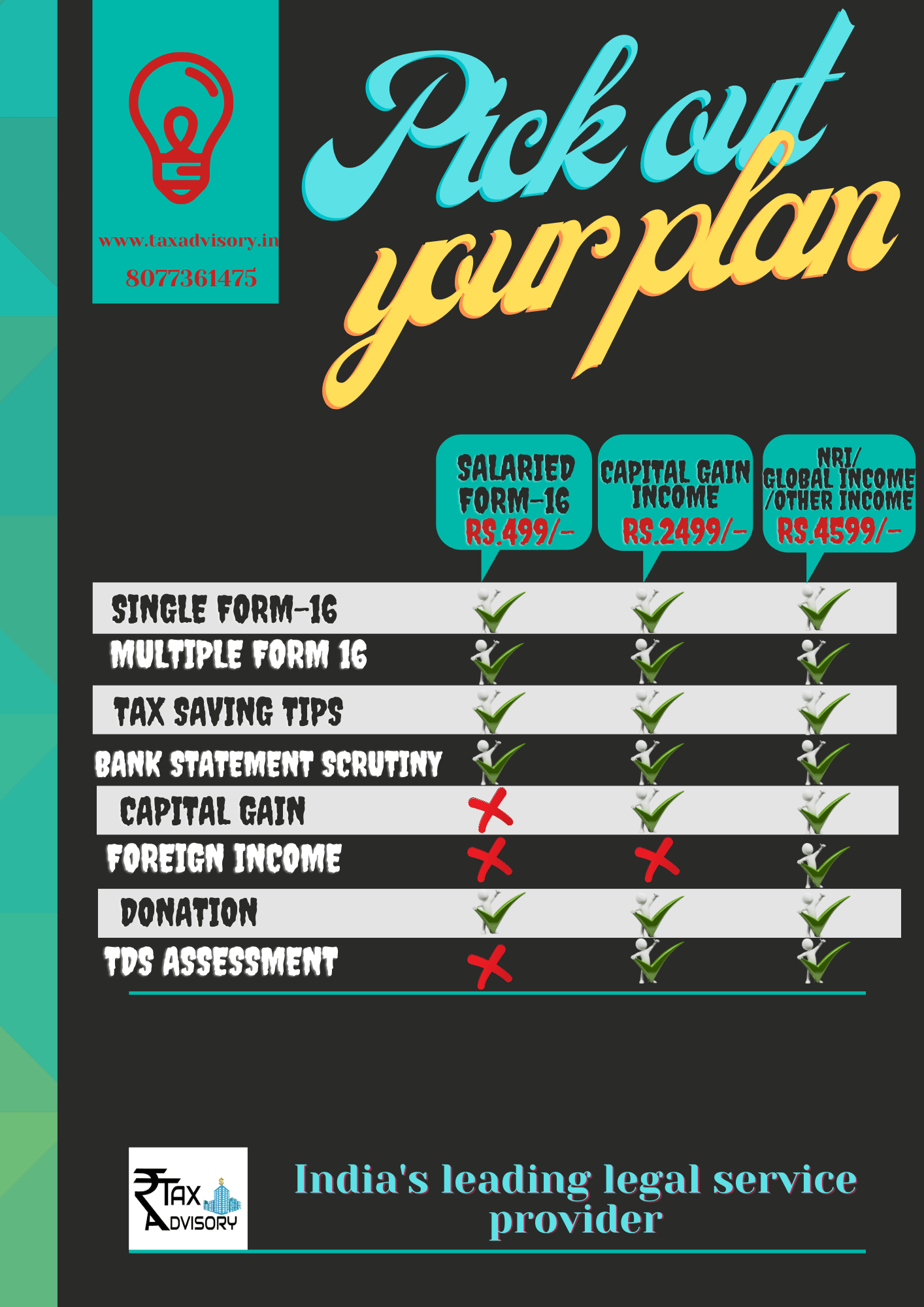

Fees for ITR Filling

Team Tax Advisory Provides Best Consultancy in ITR Filling. We have following Packages for Income Tax Consultation & Return Filling. Choose your Suitable Plan & Get Expert's Assistance Today by Submitting Your Detail here- https://taxadvisory.in/t/contact-us/

Penalty for late ITR Filing for F.Y. 2020-21 (A.Y. 2021-22) as per section 234AF

|

E-Filing Date

|

Total income below Rs. 5,00,000

|

Total income above Rs. 5,00,000

|

|

Up to 31st July

|

Rs. 0

|

Rs. 0

|

|

Between 1st August 2021 to 31st December 2021

|

Rs. 1000

|

Rs. 5000

|

|

Between 1st January 2022 to 31st march 2022

|

Rs. 1000

|

Rs. 10000

|

If you don’t file INCOME TAX RETURN on time it will attract section 234AF of income tax act and you have to pay penalty charges for late filing it can be a caused to issuance of income tax notice.

So what are you waiting for if you have still not file your Income Tax Return and want to file, we the Team of TAX ADVISORY is here for you. Tax advisory is India’s best legal service provider. You just need to visit at www.taxadvisory.in or contact us directly on 8077361475.

Frequently Asked Questions

Is it mandatory to file Income Tax Return or is it necessary to file itr?

If you are an Indian citizen and your gross total income exceeds the taxable limit (2,50,000) in a financial year, then you are required to file income tax return for that financial return.

What is Advance Tax?

Advance tax is the amount of income that is paid much in advance rather than a lump sum payment at the year-end. Also known as earn tax; advance tax is to be paid in installments as per the due dates decided by the income tax department.

Who is Assessing Officer?

A.O. is an officer of the income tax department who has been given jurisdiction over a particular geographical area in a city/town or over a class of persons.

How to file ITR 2?

You can submit your ITR-2 form either online or offline

For offline:

Only the following person can file their ITR offline:

Return can be filed offline by:

Online/Electronically:

What is Form 12bb?

The 12bb form applies to all salaried individual. This form is introduced by Central Board of Direct Taxes for your investment declaration. Through this form you can reveal your expenses and investment in order to claim exemptions from your employer. Income tax 12bb form is submitted to your employer not to the Income Tax Department.

What is Tan number?

Tax deduction account number (TAN) or Tax Collection Account Number is a 10 digit alpha-numeric number issued by the Income Tax Department. TAN certificate is to be obtained by all persons who are responsible for deducting tax at source (TDS) or who are required to collect tax at source (TCS).

How to file ITR 2 online or how to file ITR2?

Online/Electronically:

What is itr-2 means?

ITR 2 means, the form that is to be filled by individual (be a resident, non-resident or not ordinary resident) and a Hindu undivided family not having gains from business and profession.

How to Tan apply online (Tan registration) or how to get tan number?

Application for TAN could be made by submitting form 49B at TIN facilitation centers. TAN application online could be applied by making an online application; there is no need of furnishing any supporting documents to the Department. An acknowledgement which is received after the application needs to be submitted with the department as a proof.

Online TAN application (NSDL tan application)

Tan application procedure

What is ITR 7?

This form is applicable to person covered under section 139(4A), section 139(4B), section 139(4C), section 139(4D)

How to get income tax copy online?

Step 1: Go to the income tax India website and log in.

Step 2: Select the ‘view returns/forms’ option to see an e-filed tax returns.

Step 3: Now click on the acknowledgement number to download your ITR-V. Select to ‘ITR-V/Acknowledgement’ to begin the download.

Step 4: After downloading, enter your password to open the document. Now print and sign the document

How to file nil Income tax e filing?

(How to file nil return in Income tax?)

First of all you need to enter your income details and deductions. Income tax will be computed and shows that you have no tax due

Now you can submit your return to income tax department.