Offers and discounts

No Cost Emi available*On Purchase of Service worth 10,000 Rs. Or More |

Get a Website worth Rs. 24999/- for your Company in just 9999/-*(Powered by Gyan Uday Technology) |

GST InvoiceGet Gst Invoice & Claim Gst Credit for your Business with every Invoice |

A private Limited company is an organization that is privately organized for independent enterprises. Such business elements limit the liability of the owner for their shareholding, the number of investors up to 200, and prohibit investors from freely exchanging shares (publicly). Private limited company registration is issued by mca.gov.in over SPICe + forms. We will make your online company registration easily available. All you have to do is give us the necessary documents for company registration, and within 15-days you will get your Private LTD Company or company registration in india. Here you will get complete guide on incorporation of company.

Limited Threat to Personal assets: Investors of a private limited company (private limited short form is Pvt Ltd.) have Limited compulsion. This implies that as an investor you will be obliged to pay for the risk of the organization, which is equal to the commitment you have made.

The Legal entity: PLC contains a separate valid element about you. This implies that the company is accountable for the administration of its resources and liabilities, Debtors & Creditors. Also, you are not accountable for this. Along these lines, creditors may not continue to retrieve money against you. Thus, it is Appropriate for start-ups and new businesses.

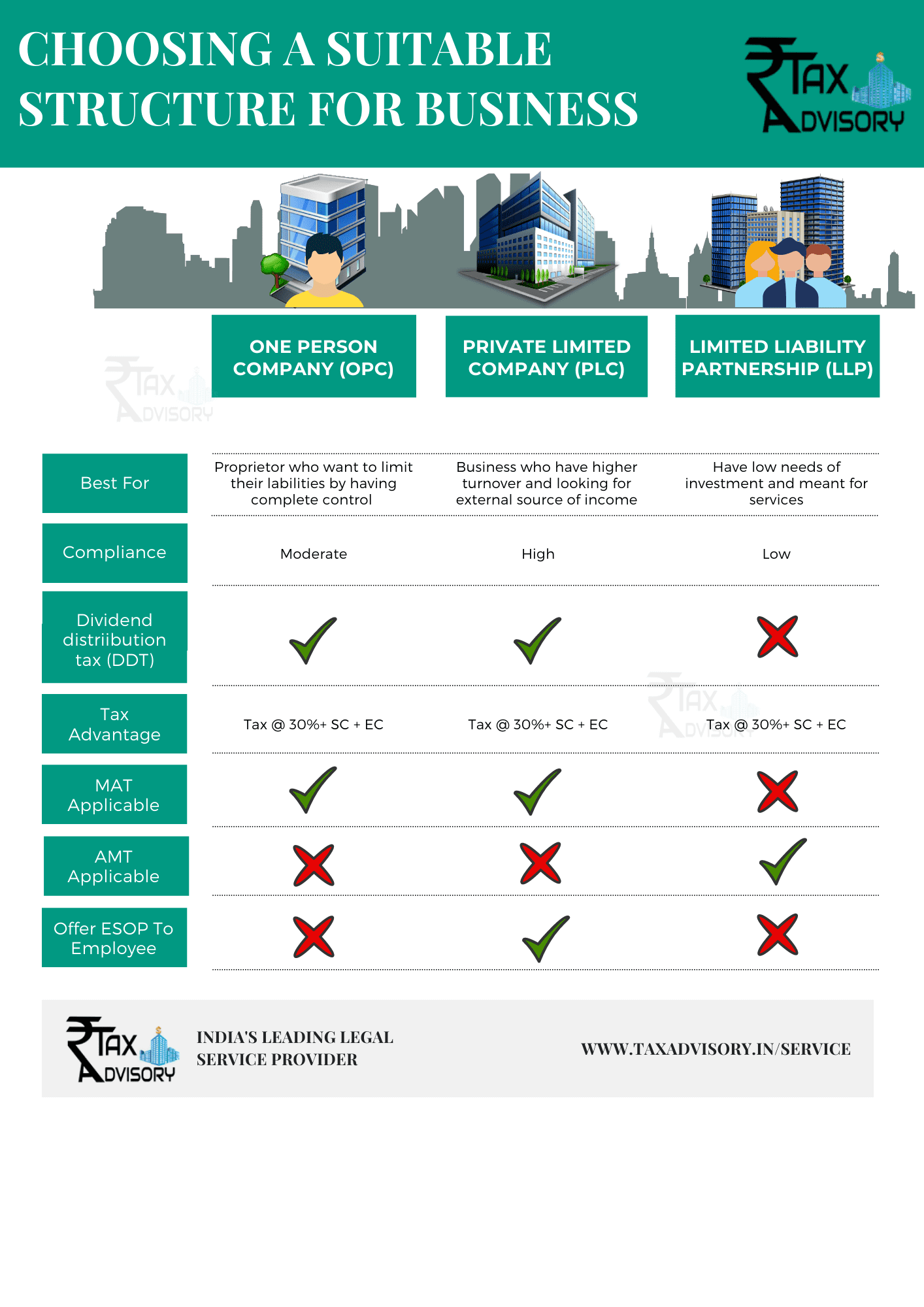

There are different types of company registration, for example,

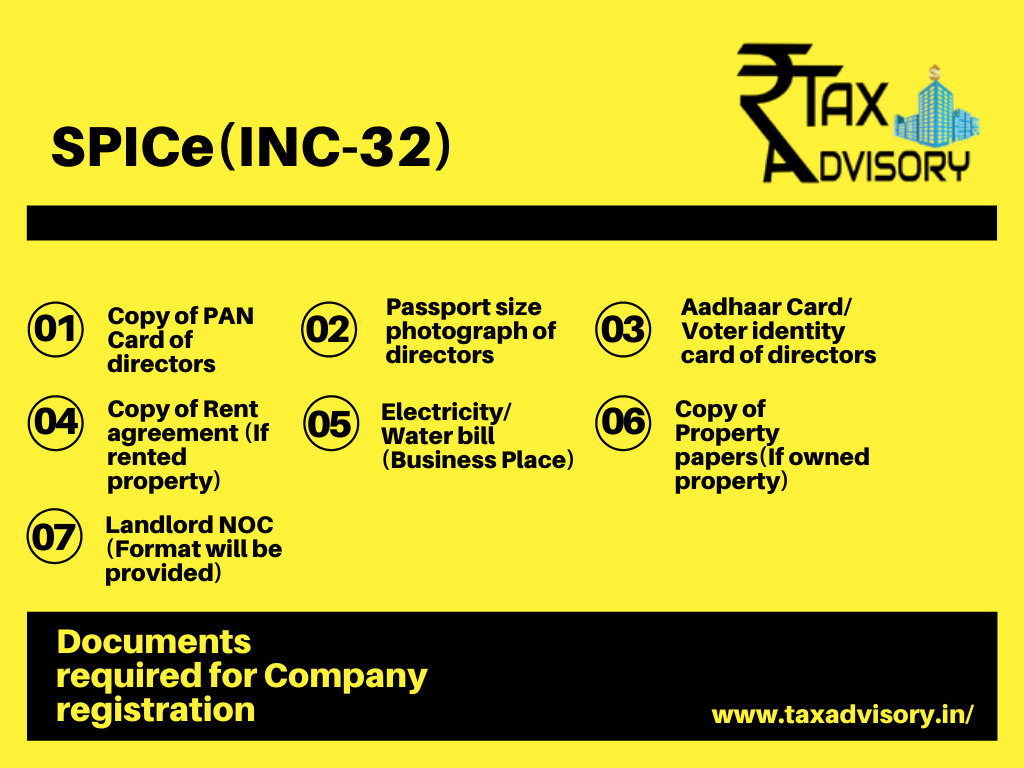

Documents required for Company Registration

Documents required for Company Registration

Rest all things are same as above

Note: Din is a type of number which is known as a director identification number.

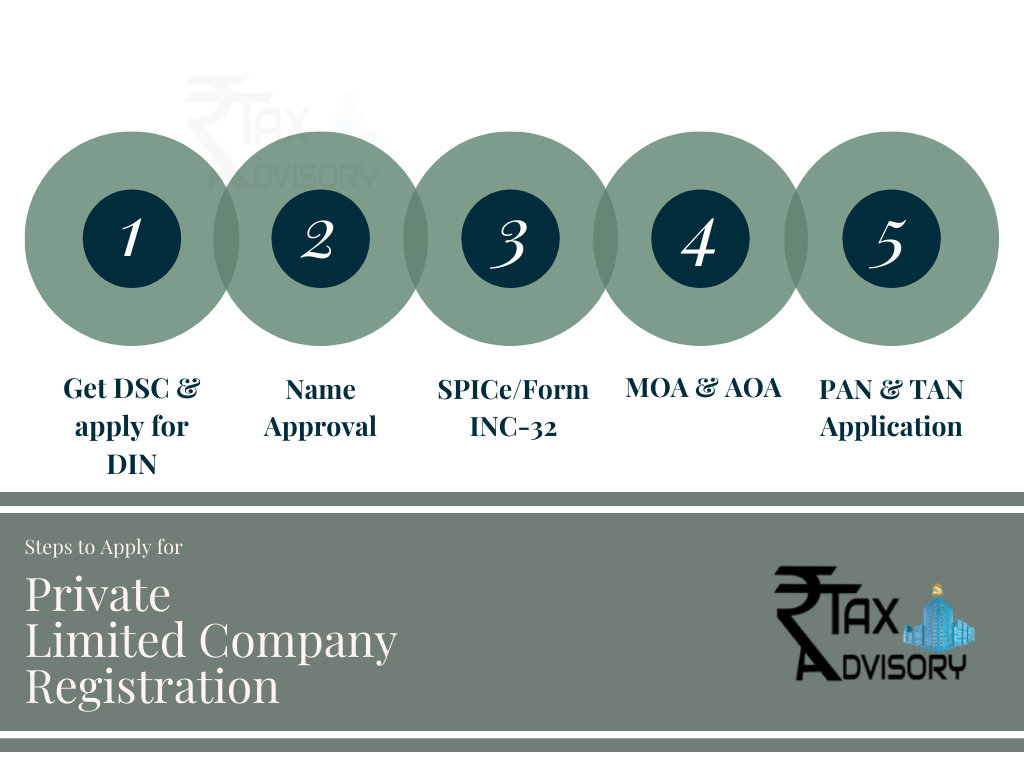

Step-1: Now we are filling the SPICe + form of your organization

Step-2: Because of filling all the above-mentioned forms, MCA will assess all reports and approve company registration online.

Step-3: Now immediately after incorporation of company, MCA will give 49A for PAN and 49B Tan with incorporation certificate and manifesto. The physical or actual copy of the PAN will be sent to your reg. address while for us a copy of PAN is enough for incorporation of company

Step-4: When filling the company incorporation application, the bank you choose will contact you and you and have the current account of a private limited organization.

Step-5: Now in case you need your trademark, GST Registration, and Import-Export permit. Gst registration will require 3 working days, import trade permit will take about 4 days.

Accordingly, register a company in india by taking the help of team Tax Advisory- India’s Leading Legal Service Provider. You can easily fill form or contact us from part of India like if you want pvt ltd company registration in pune, give us a call and you will get complete solution to all your problems.

LLP (Limited Liability Firms) is an alternative business constitution supported by the Ministry of Corporate Affairs (MCA). If you are now sure and things about the exact difference between LLP vs pvt ltd company, it can help at that time-

At this point when we are a Limited partner in Systematic 2 or 3, we alone are investing cash, this means we do not need to raise an account from outside, so in any case, we potentially incorporate LLP. Else Private limited is the best option for both present and future. If it is about compliance compared to LLP, they have less compliance than a incorporation of company organization. Thus, you can easily get your answer to choose the most preferred one.

Private Limited Company Registration Fee

Pvt ltd company registration fees (in the market) -

After launching the SPICe + Form, the company formation has a lower cost than before.

If you opt for this one, then it can’t be sure how much you will pay for till the completion of the process and it might be time taken process.

Following things are there that are included in the above-mentioned package-

An initial payment of Rs 2000 is required to start the online company registration process. We will apply for the approval of the name in MCA and start collecting your documents for further process of online company registration

Frequently Asked Questions (FAQ)

Q) Is it possible to apply for pvt ltd company registration with a residential address?

Yes, it is possible and you can easily apply for it. But you need to get approval from the Ministry of Corporate Affairs (MCA). Failing which may result in rejection of approval. We can help you in getting instant approval for your private company registration with a residential address. Click here to apply now!

Q) What is the list of documents required for incorporation of private limited company in india that has to be attached with Form 8?

There are three main documents you need to attach with Form 8, these are as follows-

Q) Is there any difference between MOA and AOA?

Yes, these two things may vary from each other as MOA is Memorandum of Association which is under 2(56) of companies Act 2013. That must show the foundation where the company is built, while AOA is an Article of Association is comes under section 2(5) of the companies Act. Here you will get all the things related to the rules and regulations of the company management.

Q) Do I have to visit the office in online company incorporation?

No, Online incorporation of company is quite easy process, all you need to do is send us the necessary documents. We will register your company at your fingertips.

Q) How much time is required for the registration of a new private limited company in India?

If your private limited company (pvt full form) has completed all the required documents, then it will take about 15 days to register your company.

Q) What is DSC (Digital Signature Certificate) in limited company?

Digital signatures are Digital Signature Certificate (DSC) physical or the digital equivalent of the paper certificate (which is electronic format). Certificates serve as proof of a person's identity for a certain purpose. It can be stored in any form like in the cloud or pen drive.

Q) Is it compulsory to attach AADHAR or PAN?

The Companies (Incorporation) Third Amendment Rules dated 27th July 2016 has relaxed the mandatory attachment of proof of identity and residence. Thus, it is not mandatory to submit it but you have to provide a DIN Number.

Q) Is trade license required for private limited company

Yes, a trade license is required for a private limited company to operate legally in most countries. The requirements and procedures for obtaining a trade license may vary depending on the country and local laws. It is advisable to consult with a local business expert or government agency to determine the specific requirements for obtaining a trade license for a private limited company.

Q) how many shareholders can a private limited company have

A private limited company can have a maximum of 200 shareholders.

Q) how are profits shared in a private limited company

In a private limited company, profits are shared among the shareholders in proportion to their shareholding in the company. The profits are typically distributed in the form of dividends, which are paid out of the company's profits after all expenses and taxes have been paid. The amount of dividend paid to each shareholder depends on the number of shares held by the shareholder and the company's dividend policy. The company's board of directors decides on the dividend amount and frequency of distribution, subject to the approval of the shareholders at the annual general meeting.

What You'll Get