Offers and discounts

No Cost Emi available*On Purchase of Service worth 10,000 Rs. Or More |

Get a Website worth Rs. 24999/- for your Company in just 9999/-*(Powered by Gyan Uday Technology) |

GST InvoiceGet Gst Invoice & Claim Gst Credit for your Business with every Invoice |

A sole proprietorship refers to a person who owns the business and is personally responsible for its debts. It is an unincorporated business in which only one owner is liable for paying personal income tax on profits earned. Proprietorship Firm India does not have any separate identity under the law. The Sole trader receives all profits and owns every asset of the business. It can sue and be sued in the owner’s name. A sole proprietorship registration is a convenient and simplified way to start your business in India. An individual who wishes to sell their product or services can run their business as a sole proprietor. Some common examples of sole proprietorship businesses are consultants, home-based businesses, grocery, chemist and saloons, etc.

In this article, you will get to know the documents required for registering your proprietorship firm, the compliance required for sole proprietorship registration, and the process of registering it.

Meanwhile you just need to stay with us

An individual who is the owner of a sole proprietorship firm is known as a Sole proprietor or a Sole trader. The proprietorship firm of a sole trader is own by the proprietor alone. The loss and profit of the firm are considered as the loss and profit of the sole trader also the income of the Proprietorship Firm is considered as the income of the owner as per the income tax act. There are some licenses and documents are required you for running a business as a sole proprietorship in India. The requirement of the license will depend upon the industry, state, and locality of the firm.

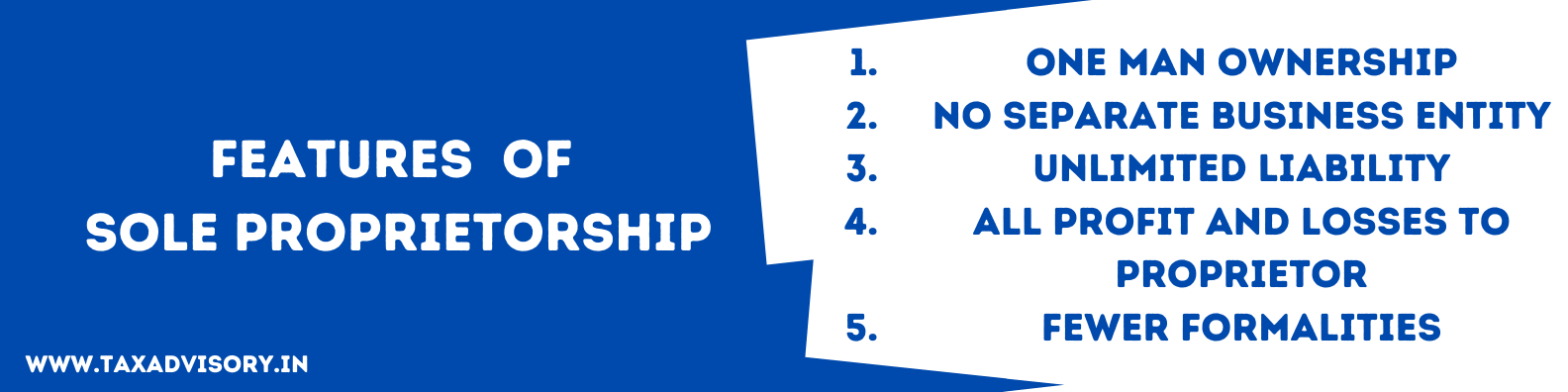

Features of sole proprietorship

Features of sole proprietorship are as follows:

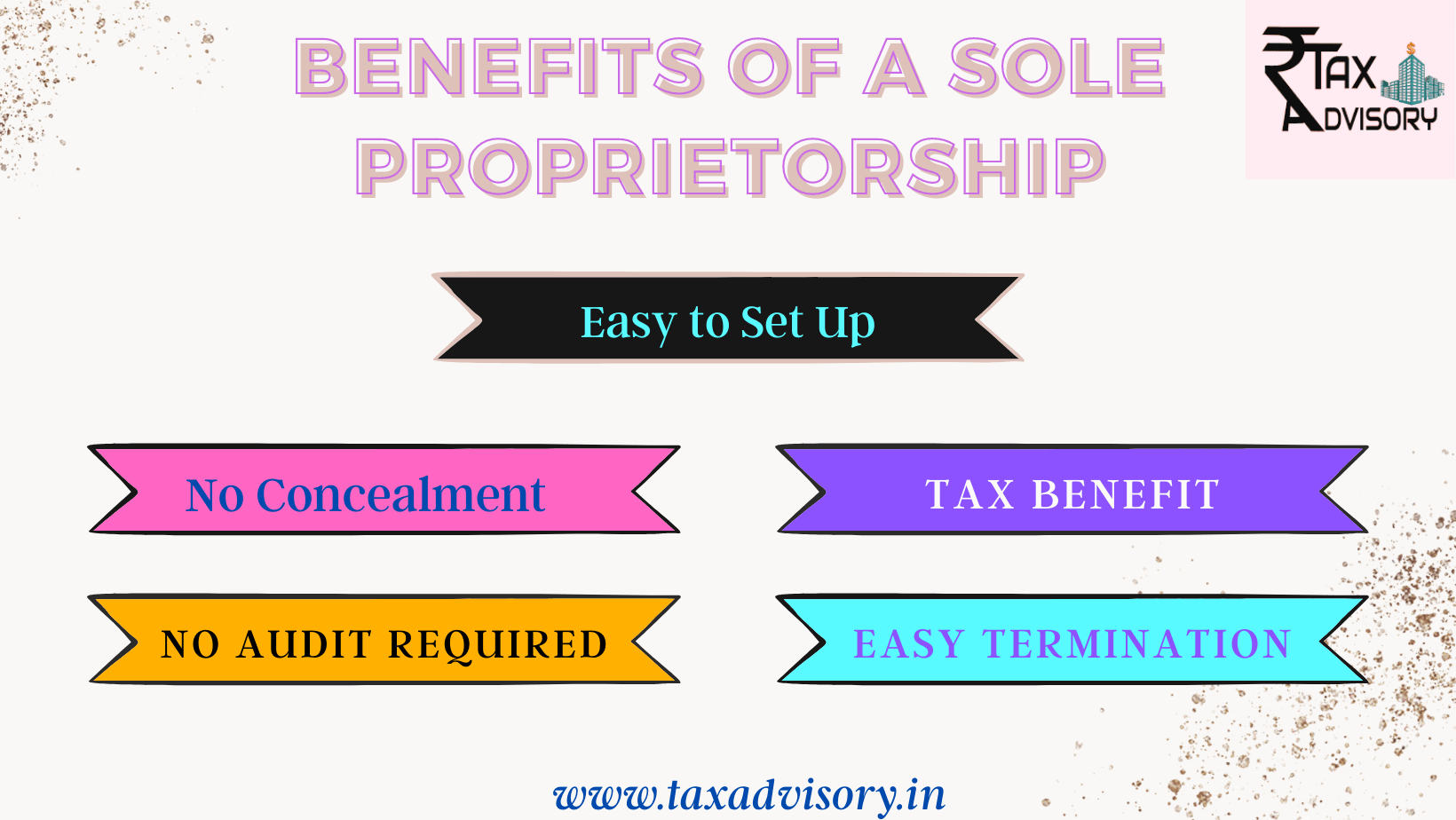

1.Easy to set up: - There is no specific registration requirement for setting up a sole proprietorship business. Hence, a sole proprietorship business can started without any registration. Sole proprietorships are inexpensive, and the only fees involved for those who needed to register their business name, and to attain the appropriate licenses and permits

2.No concealment: -As the proprietor is the sole trader of firm, there is no other person who can interfere or conceal their business ideas. There is high secrecy in this business as the business is handled by proprietor himself in addition proprietor is not bound to reveal or publish his accounts

3.Tax benefit: -The compliance requirement for sole proprietor is minimal as the proprietorship firm is not registered with any government authority like the ministry of corporate affairs. If your income is more than 2.5 lakh per annum you are required to file income tax return. The Sole Proprietor can reduce their income tax liability by availing below mentioned deductions:

4.No audit required: - If you are a sole proprietor you are not mandatorily required to get your businesses audited under the eye of law. However, the audit will depend upon nature of business and their threshold turnover limits.

5.Easy termination: - It is easy to terminate business for proprietor as he is the sole owner of business with no co-owner or partners. Closure procedure is very simple with minimum formalities.

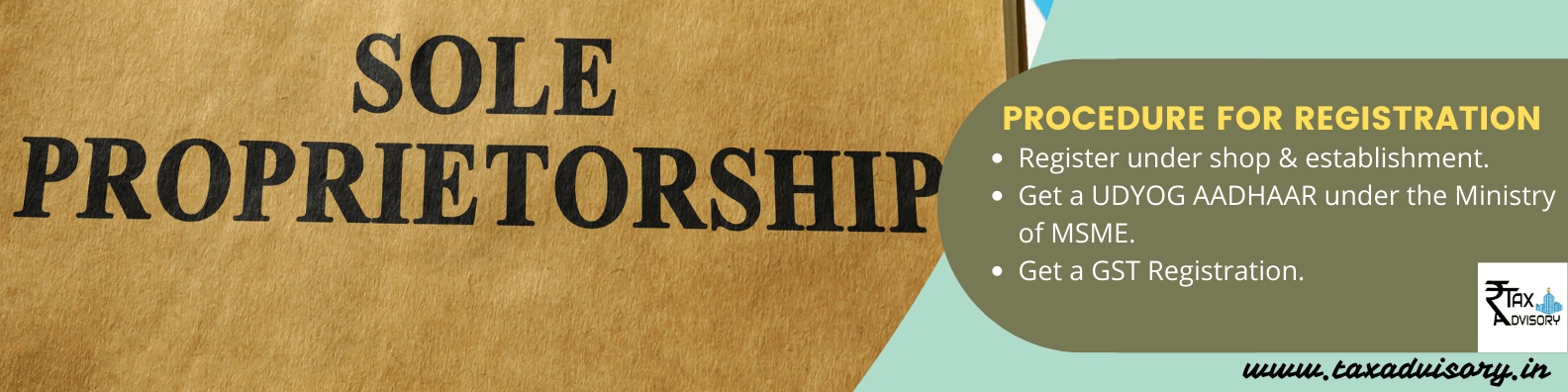

(How to register a sole proprietorship in India OR How to register a proprietorship firm)

Registering a sole proprietorship firm is a digital process that can be done with the help of an expert. There are three ways to register a sole proprietorship in India

Sole Proprietorship Registration under shop and Establishment Act

Shop and establishment Act license is not mandatory for all the sole proprietorship firms but most of the firms have to obtain this license, as per the local laws of the region of the business. This license is issued by municipal party and this license is given on the basis of number of employees working in a company. A sole proprietor can register his legal name of the business (as mentioned in PAN) under the Shop and Establishment Act & get Shop Act license or Trade License if he has a shop as a place of business. Here shop means any place where:

It does not include a factory, a commercial establishment, and residential hotel, restaurant, eating house, theater or other place of public or entertainment.

Sole Proprietorship Registration through Udyog Aadhaar under ministry of MSME

Individual requires registering as an SME (small and medium enterprise) as per the MSME Act. For it, you have to submit an online application. Udyog Aadhaar is a new method of registration under ministry of MSME. It has replaced the old method of registration, where from EM-I and EM-II were used to register. It is not compulsory to get an MSME (Small and Medium Enterprise) registration, but it improves the chances of the business to get loans and helps in other legal matters. The process of obtaining the Udyog Aadhaar registration is completely online. The major objectives of the Udyog Aadhaar registration are as follows:

Sole Proprietorship firm Registration through GST Registration

GST Registration is necessary only, if annual turnover is more than Rs. 40 lakh and Rs. 20 lakh for businesses operating in North-eastern states. GST has replaced many indirect taxes such as the service tax; value added tax, central sales tax, and additional custom duty and so on. Getting GST registration will help the business owner to keep his/her taxation in check throughout all the transactions made in the name of the proprietorship firm.

Small businesses can also opt for the composition scheme to lower the tax rates which has reduced the taxation and the compliance burden significantly. GST registration for sole proprietorship (GST registration for proprietorship) is a great method of getting recognition for your sole proprietorship concern. Every registered business has to compulsorily collect the tax from the customers and file the GST returns. For registering under GST, you need the following documents-

If a sole proprietor has a turnover of less than Rs. 20 lakh, it is not mandatory for him to get registered and collect GST.

If you opt for GST registration for sole proprietorship India then you won’t need for MSME registration. After GST registration of your sole proprietorship firm, you will get GST certificate and current account of your sole proprietorship is opened in bank and your sole proprietorship firm will be registered.

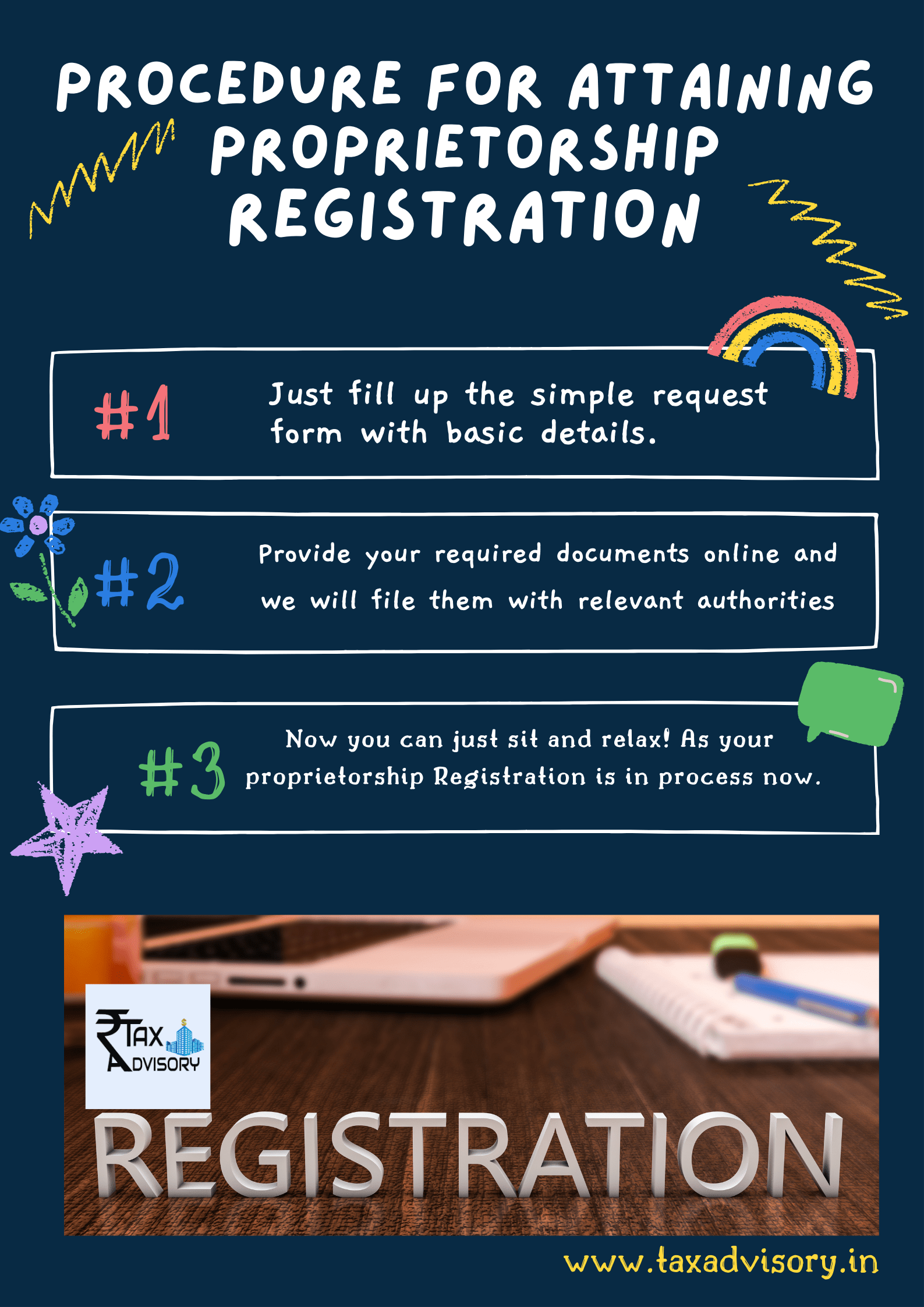

How can TAX ADVISORY help you in attaining sole Proprietorship registration India?

It is completely an online registration process. You are not required to submit your documents manually.

Step 1: - Just fill up the simple request form with the basic details.

Step 2: - Provide your required documents online and we will file them with relevant authorities.

Step 3: - Now you can just sit and relax! As your proprietorship Registration is in process now.

Post Incorporation compliance for the sole proprietorship

What is proprietorship firm?

Sole proprietorship is a single person establishment where the individual manages and controls their business on their own. It is a simplest business form under which one can operate a business.

Who can be a proprietor?

Any Indian citizen who is a resident of Indian can become a proprietor.

Can I keep any name of the firm?

Yes, you can keep any name of the firm but it is not related to the private limited company or limited liability partnership or One Person Company.

What are the disadvantages of proprietorship firm?

What are the documents required for opening a proprietorship firm?

GST registration documents for proprietor

What are the annual compliances for a proprietorship firm?

GST Return and Income Tax Return must be filed by a proprietorship firm.

Am I required to be physically present to register sole proprietorship India?

No, you are not required to be physically present at the time of registration. You can send us your documents via our email id or contact us directly on 8077361475.

Can an NRI become a proprietor?

No, NRI cannot become a proprietor.

Which act governs the sole proprietor companies in India?

Sole proprietorship company name list are not examine as separate legal entity from their owners, so there is not any separate act for them.

What are the GST registration documents for Proprietor?

Documents required for GST registration for Proprietorship (GST for proprietorship) are as follows:

How to apply PAN card for proprietorship firm?

There is a step by step procedure to apply for PAN card for Proprietorship Company (proprietorship firm PAN card), which are as follows-

After making payment for the application for the proprietorship firm PAN card, an acknowledgment number will be generated which you need to save.

Is there any way to reduce the proprietorship firm fees?

Yes, if you choose simple MSME with CA certification or GST anyone then it’s reducing your cost because shop act or ITR or trade license etc are very expensive for startups.

How much money required for starting a proprietary firm?

There is not much amount of money is required for starting a proprietary business, you can start your business with any amount in your business.

How to open current account for sole proprietorship in India?

For opening a current account, there are certain documents which are required to submit to the bank. After submitting certain documents, the account opening formalities can be completed, and the current account can be opened. Documents required to open a current account for a proprietorship firm are as follows:

Proof of existence of business; any of these documents will be enough to establish proof of the existence of the business:

How do I download proprietorship registration form?

You don’t need to download form; you can just visit TAX ADVISORY and fill up the form online.