Offers and discounts

No Cost Emi available*On Purchase of Service worth 10,000 Rs. Or More |

Get a Website worth Rs. 24999/- for your Company in just 9999/-*(Powered by Gyan Uday Technology) |

GST InvoiceGet Gst Invoice & Claim Gst Credit for your Business with every Invoice |

To Import/Export Goods or services in foreign countries, you need to procure an Import/Export License. An Import/Export License is a 10-digit numeric code commonly known as Importer-Exporter-Code (iec certificate) which is registered under the Customs Duties Act 1962. This License permits a trader to import and export outside the country. Tax Advisory will help you obtain your import export license without a hassle.

When you need Export Import License

Generally, a trader would need an iec code in the following conditions: -

Note: - To get several rewards(benefits) from the Government. It is essential for a trader that he or she should have an IEC Code registration.

First of all, all the merchants should choose their specific product. An iec number will be granted only for the product category applied by the merchant. If A trader has not registered his firm. They should first decide the name of the firm for example, if a trader wants to do import / export business then he can choose a name like Sharda Export Company. After choosing the name he should register his firm. Now a merchant can apply for apply iec code online, then register an import / export company with the nearest airport or seaport.

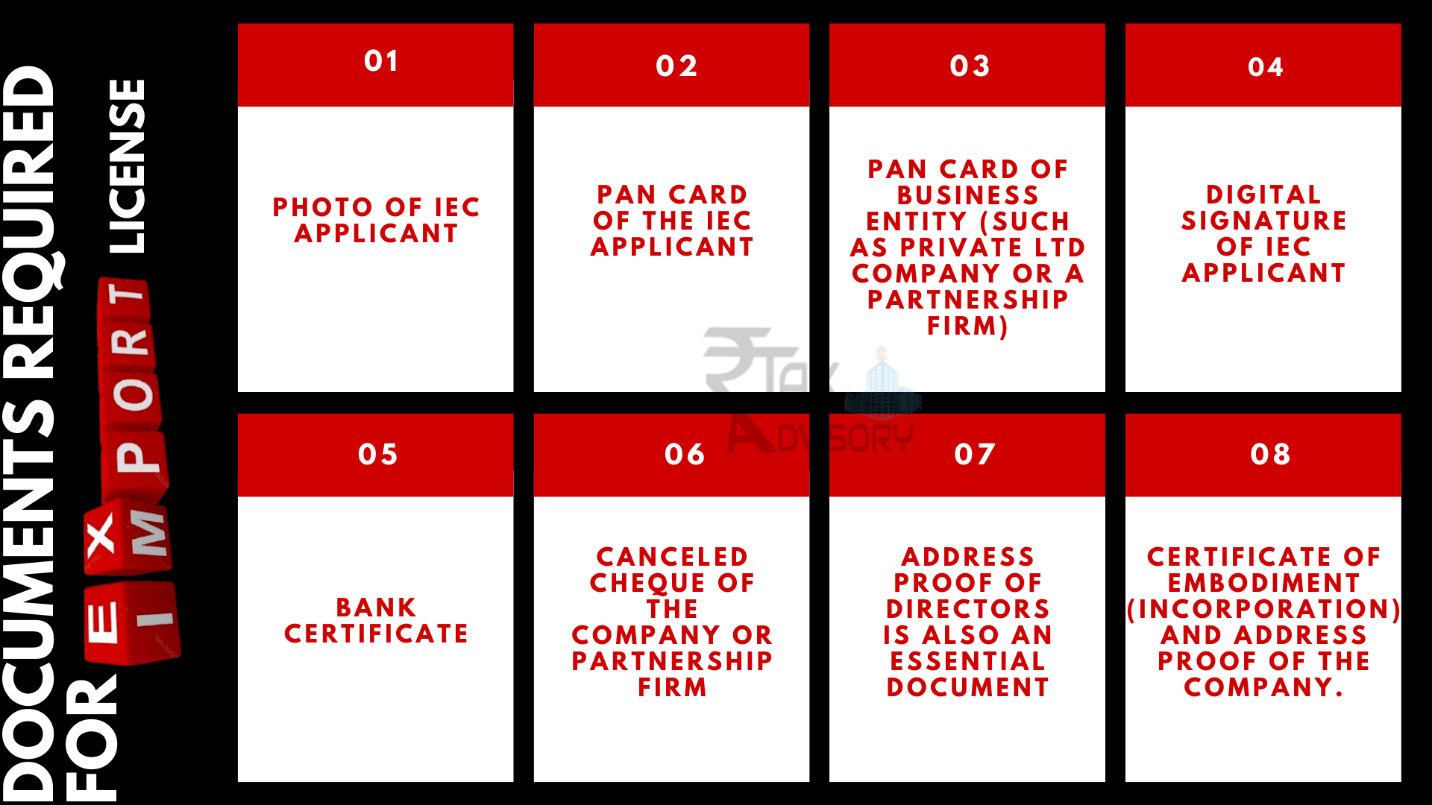

Following Documents are required for the IEC registration application:

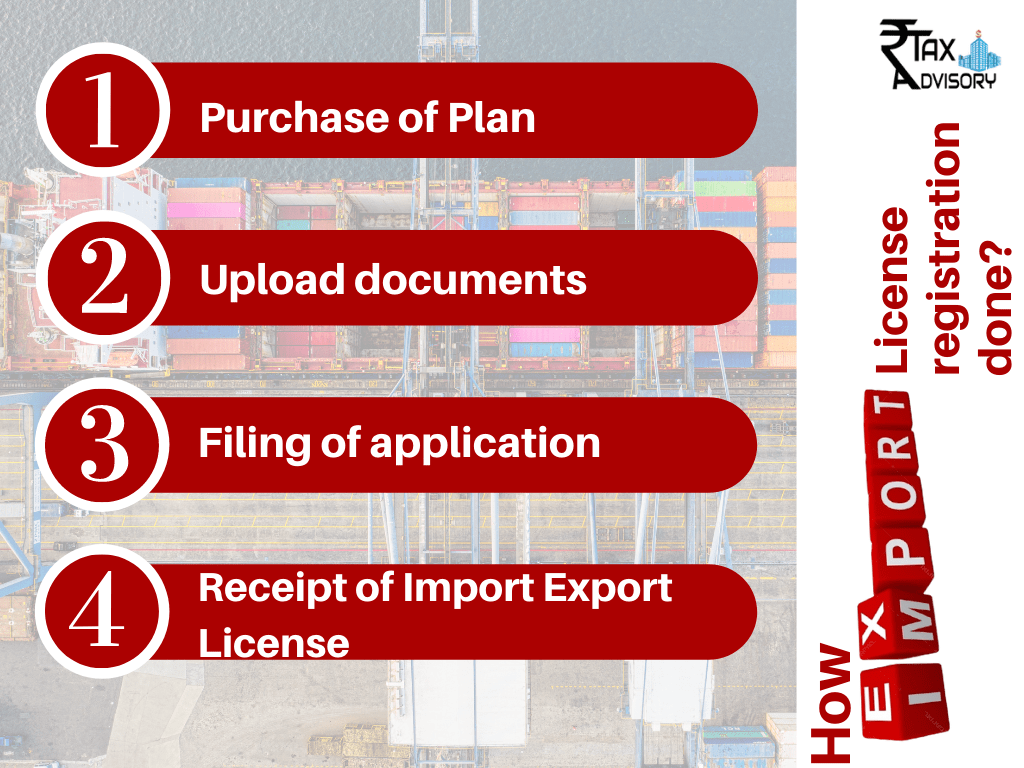

How it is done?

If you are looking for IEC registration, then it is important to get in touch with the best legal business companion like Tax Advisory. Here you will get it done at very reasonable rate within few days. Our import export license fees are as follows-

Proprietorship firm- 2499/-

Partnership Firm- 2999/-

Private limited Company- 3499/-

all fees are inclusive of all taxes.

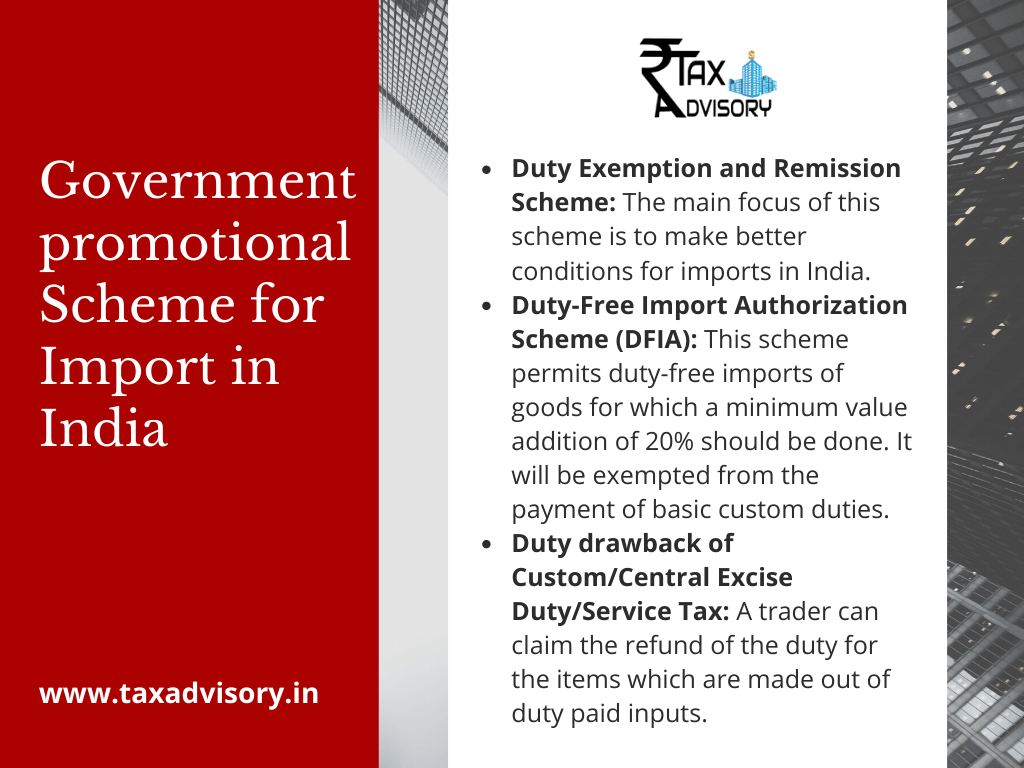

Government promotional Scheme for Import

Schemes for the promotion of Import Export

Some of the Government schemes for the promotion of Import Export are given below: Export from India, two schemes come under this category:

Note: A trader may use these Credit Scrips to make payment of custom duty, service tax, and excise duty.

Note: Under this Scheme, the incentive provided in the form of Credit Scrips can be easily sold or transferred to any other person. A trader can also make payment of various taxes during the import or export of services, by making use of Credit Scrips.

Rules and regulation set up by the Government for Export & Import License

If a person wants to enter the Export-Import business and want to get export import code of Organic food product, then it's mandatory of a person to adhere rules and regulation set up by the Government for which you have to procure the following mandatory Licenses: -

Things to keep in mind before exporting organic food

If a person wants to export organic food products, then it is required to follow the following steps: -

Eligible Products for Export and Import License

Generally, in India, Import & Export business comes under Foreign Trade (Development & regulation act 1992 and it is governed by the Government of India Export-Import Policy.

In India, the import and export of a large number of all products are free, except for those items which are regulated by Import & Export policy. In fact, registration with the regional licensing authority is necessary for the import and export code of products.

Note: The Custom Authority will not permit the clearance of products unless the importer or exporter has procured an importer exporter code registration (IEC) from the regional Licensing Authority.

Here you can have an overview of the Import & Export Policies of the Government of India: -

Note: The items not specified in these three categories, can be imported without any restriction if the importer has procured a valid iec code registration. There is no need for any import license to import such types of products.

Those goods, which are not listed under ITC (HS) Classification, can be exported without any restriction. Here you can have detailed information of classification of goods for export

Note: These types of products are normally not permitted to be exported to foreign countries.

Tax Advisory will easily execute the import-export license online registration process for you. Our enthusiastic representatives will file import export registration on your behalf. After submission; We will do the necessary coordination with DGFT to expedite your application. We will make sure that you get your import-export license in just a few days.

Frequently Asked Questions

Q) how to get import export license in india ?

To get an import-export license in India, one needs to follow these steps:

1. Obtain a valid PAN card.

2. Register a business entity (Partnership firm, LLP, Pvt. Ltd. Company, etc.).

3. Open a current bank account in the company's name.

4. Obtain an Import Export Code (IEC) from the Directorate General of Foreign Trade (DGFT) by submitting the required documents, such as PAN card, bank certificate, and identity proof.

5. Register with relevant export promotion councils for the specific product category.

6. Obtain necessary licenses and permits from concerned government agencies depending on the nature of the goods to be imported or exported.

7. File the required documents with customs authorities and ensure compliance

Q) how to start import and export business in india

Starting an import and export business in India involves the following steps:

1. Obtain an Import Export Code (IEC): This is a mandatory registration with the Directorate General of Foreign Trade (DGFT). An IEC is a 10-digit code that is used to identify exporters and importers in India.

2. Choose a product: Decide on the product or products you want to import or export. Research the market demand, competition, pricing, and regulations related to the product.

3. Find suppliers and buyers: Research and identify reliable suppliers and buyers of the product, both domestically and internationally.

4. Establish a company: Register a company with the Registrar of Companies (ROC) or start as a sole proprietorship or partnership.

5. Obtain licenses

Q) how to get an import export licence

To get an import export license, you will need to follow these steps:

1. Decide on the type of import-export business you want to start - Identify the products and services you want to deal with.

2. Choose a business name and register your company - You need to register your business with the government and obtain a unique business identification number.