Offers and discounts

No Cost Emi available*On Purchase of Service worth 10,000 Rs. Or More |

Get a Website worth Rs. 24999/- for your Company in just 9999/-*(Powered by Gyan Uday Technology) |

GST InvoiceGet Gst Invoice & Claim Gst Credit for your Business with every Invoice |

Wish to open up a Business in Mumbai or any state of Maharashtra? Have you taken the Shop and Establishment Certificate? If no, then get Gumasta License Now!

Now, you are in dilemma- What is Gumasta License? Why gumasta registration is important? How to get it? What is the application procedure? What is the fees? And many other questions must be running your mind.

In this section, you will get all your answers that will erase the negative thoughts from your mind and it will pave an easy path for your business. If you are a prospective Business man, you need to be aware of Gumasta’s existence.

Gomastha (also spelled as Gumastha or Gumasta), which means an Indian agent. This name was assigned to Indian agents by the British East India Company, who were employed in the Company’s colonies, to sign bonds, by local weavers and artisans; in order to deliver goods to the company. Therefore, Gumasta License was declared mandatory for any shop/business establishment in India.

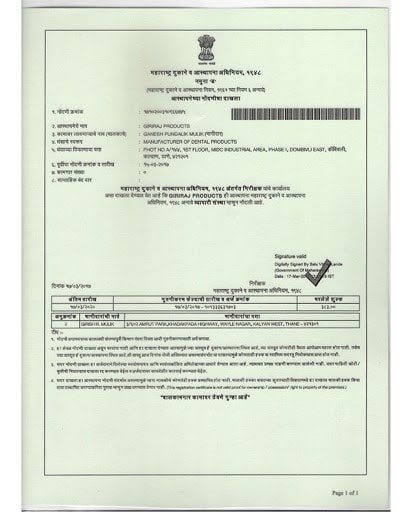

Gumasta Licence or Shop & Establishment license is a registration/certificate, which is required to undertake any kind of Business in India for which you get registered with a state municipality. The Municipal corporation of every state grants a certificate that allows a person or a team of people to perform their business activities legally.

Talking about who requires Gumasta License in Mumbai or Gumasta License in Maharashtra, this license is required for doing any kind of business in the state of Maharashtra. It is governed by Municipal Corporation of Mumbai under the supervision of Maharashtra Shops & Establishment Act, 1948. This license gives authority to do your business at a particular place recognized by Government of Bank for all business irrespective of whether it is done by a single person or big organization.

It also named as gumastha or gomasta but its legal name is gumasta. It is mandatory for all businesses in Maharashtra which have 10 or more employees in its shop or establishment. A business that fails to obtain its Gumasta License becomes liable to heavy penalties and punishments. Gumasta is shop establishment certificate in Mumbai.

Stroll through the benefits of getting a Gumasta License mentioned below:

Once you get the Gumasta License, it must be displayed at an important place of your establishment. The license is valid for 1 year and after then, a renewal application will be filed again every year. Such renewal application must be filed at least 30 days before the expiry of the Gumasta License.

Team tax advisory will Provide you the Gumasta License of your shop in Mumbai in just 2299/- (inclusive of all taxes)

Above package includes-

All the documents listed below are certain specific documents required for the registration, apart from the general documents:

Want to know more about Online Registration Procedure for Gumasta License in Mumbai?

Types of Forms for Gumasta License

Following are the types of forms to be filled online:

Penalties for Business without Gumasta License

Businesses that fail to obtain or avoid to get Gumasta license are liable to heavy penalties (Approx. Rs. 1 lakh & Additional Fee of Rs. 2000/day). However, for repeated lawbreakers the penalty charge may extend up to Rs. 2 lakhs.

How to Cancel Gumasta License/ Certificate?

Therefore, SAVE yourself from Gumasta License Penalty and run your business or new establishment smoothly in the state of Maharashtra.

For more information, Tax Advisory can help you with it. Contact us without a pause…

GOOD LUCK for your GUMASTA LICENSE & BUSINESS ESTABLISHMENT IN MUMBAI!!